Increasing margin pressure and a heightened battle for market share are two of the most significant issues facing restaurant operators today. Both factors are driven in part by current labor conditions.

Profit margins are being squeezed because of external labor considerations, such as the doubling of the threshold for overtime and the ongoing effort to raise the minimum wage.

Complicating the matter further is the re-emergence of a tighter labor pool. In fall 2015, Bruce Grindy, Chief Economist at the National Restaurant Association (NRA) said, “There are indications that job vacancies are becoming more difficult to fill.”

Anecdotal evidence of these difficulties has been piling up across the country. “The Chicago labor market is tighter than it’s ever been,” says Terry McNeese, General Manager and Wine Director at de Quay, a Dutch-Indonesian restaurant on the city’s near north side. More competition for labor means higher employee-acquisition and turnover costs.

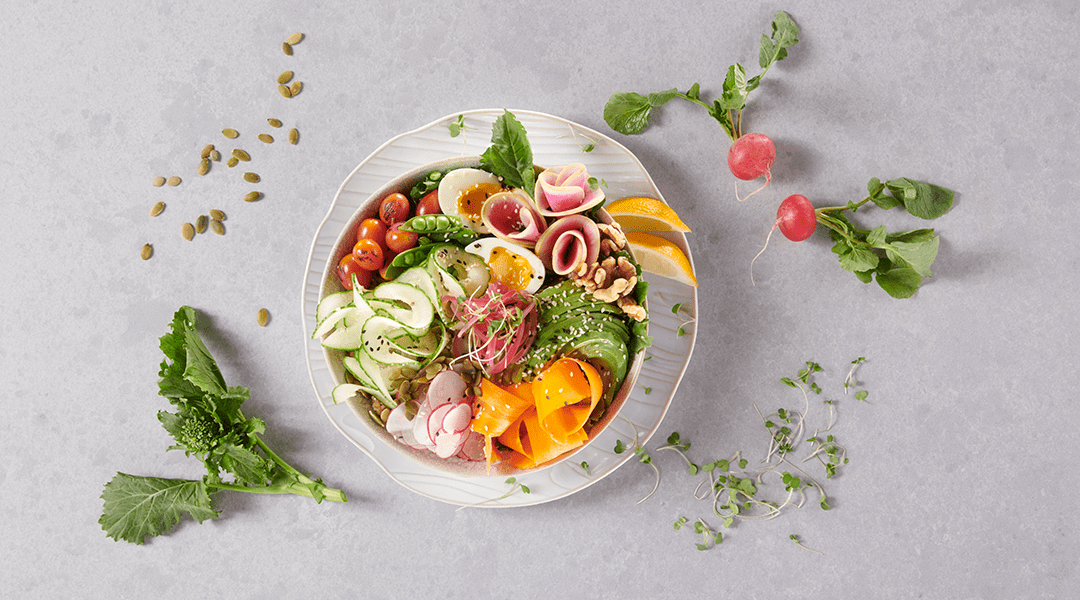

The battle for market share is also compressing margins, as full- and limited-service operators now have to compete with delivery services, “grocerants” and even home-meal preparation. Consumers are choosing these options more frequently because they question the value—a combination of dining experience and price—that full-service restaurants are able to deliver.

“Today’s consumers are far less willing to accept the kind of inconsistent, undefined dining experience that staffing issues can create,” says Gordon Food Service Commercial Segment Manager Doug Owens. “When the quality of the dining experience falters, price becomes more important, and other foodservice outlets have a clear advantage over full-service restaurants in this regard.”

While your ability to influence external labor factors is limited, you can do a great deal to mitigate the margin impacts of employee acquisition and turnover.

Multiple solutions for a multifaceted problem

With multiple factors at work in this new labor environment, there’s no single solution for improving profitability and gaining market share. Operators must develop a strategic plan with multiple tactics. The following are necessities of any approach:

Benchmarking. Start with benchmarking your operation to determine the real financial impact of labor/staffing issues. This will help you determine how your operation is performing against similar operations and guide you in developing achievable goals to reduce labor costs.

The NRA provides a starting point with its Restaurant Industry and Operations Report. By providing general foodservice-industry standards—such as labor accounting for 33 percent of costs in full-service restaurants—it will enable you to gauge your relative performance.

“Operators should purchase this report annually to continually set reasonable goals and track progress against those goals,” Owens urges.

Hiring and recruiting. Before beginning the tactical process of hiring, define the value proposition you offer employees.

“Think of potential employees the way you think of customers,” advises Lisa McKiernan, Manager of Talent Acquisition for Gordon Food Service. Just as you create a brand that promises customers a unique dining experience, build one that promises employees a unique working environment. “Recognize that you are being interviewed by candidates who have options,” she continues. “Give them a compelling message that speaks to their needs and expectations.”

As noted earlier, those needs and expectations have shifted over time. For one thing, millennial employees won’t automatically grant their devotion. You need to earn their loyalty over time—just as you do with consumers—by carrying through on the promises you’ve made.

One way to do this is to involve them more fully in your operation. “Millennials want engagement and transparency from employers,” Owens says. “They want to have influence and ‘skin in the game.’”

McNeese promotes this kind of inclusion at de Quay. “When I interview candidates, I stress that we train employees to learn the craft of our process, our cuisine and our beverages, so that they can take initiative with our customers.” Getting to know the business inside and out is not a static process. “Potential employees have to be passionate about learning, always learning, so we can continue to offer customers a unique experience.”

McNeese’s approach works. “With the knowledge we give them, our employees could go elsewhere in the city and make more money. But they continue to stick around.”

“Getting the right people on your team, as de Quay has managed to do, is critical,” Owens says. “It significantly improves profitability by diminishing training and turnover costs. Consistency in employees also helps drive a consistent dining experience over time, keeping the brand promise with consumers.”

The hiring process. This has evolved as radically as the work values of today’s employees. Emboldened by technology, people are searching for jobs and making employment decisions in a much shorter timeframe. Operators must provide multiple technology touchpoints to reach job candidates.

“Internet job postings, online applications and pre-vetting solutions that identify candidates with desired behaviors and attributes have changed the process for employees and employers alike,” Owens says. These technologies can help position you as an employer of choice while reducing the time and cost of employee acquisition.

Retention/motivation. Retaining employees in a highly competitive market is challenging. Higher competitive wages can drive employee defections. Counteract the lure of higher pay by continuing to deliver on your value proposition—as de Quay demonstrates.

Also consider these four retention strategies:

- Rewards for performance.

- Rewards for tenure.

- Creating networking teams to engage in problem-solving.

- Leadership planning and execution.

“Operators are often reluctant to invest in retention, but it more than pays for itself in reducing turnover costs,” Owens says.

The leadership factor

None of the strategies outlined here will be successful unless you develop strong leaders. Both leadership candidates and leaders already in place should receive ongoing training, which must include an understanding of your target employees. The ability to communicate your brand and vision to employees will directly affect the employee experience—and in turn, the guest experience.

The key to resolving staffing issues isn’t in the identification of problems and potential solutions. It’s in the ability to implement solutions through strategies your leadership can deliver against. Make that happen and you’re on your way to increased profitability and guest counts.

Signs of a labor shortage

A shrinking unemployment rate, a rising number of people quitting their jobs and a corresponding increase in job openings are all signs that the labor market is tightening. Operators are feeling the squeeze—80 percent of respondents to a recent Nation’s Restaurant News operator survey cite workforce-management concerns, with recruitment and retention noted as a top concern.

Ask your Customer Development Specialist about the wide range of professional services and solutions Gordon Food Service offers in the staffing arena, including:

- Facilitating goal setting.

- Developing an annual staffing strategic plan.

- Collaborating on leadership training.

The content of this article is for informational purposes only. The information in this article cannot and should not stand in for guidance from your human resource experts.