1. Between the loan application review and receiving the money, this process will

be slow and timelines may vary based on your bank.

2. There are additional options available outside of the CARES act. Talk to

your banker, check with your local government, and look at the SBA website

for more information.

3. If you are approved to receive funding, understand what the money can be used

for in order for your loan to be forgiven before you start dispersing the capital

(for example, the SBA will forgive PPP loans if all employees are kept on the

payroll for eight weeks and the money is used for payroll, rent, mortgage interest,

or utilities).

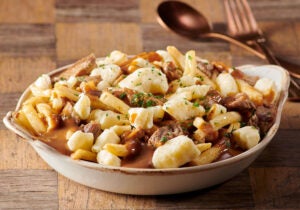

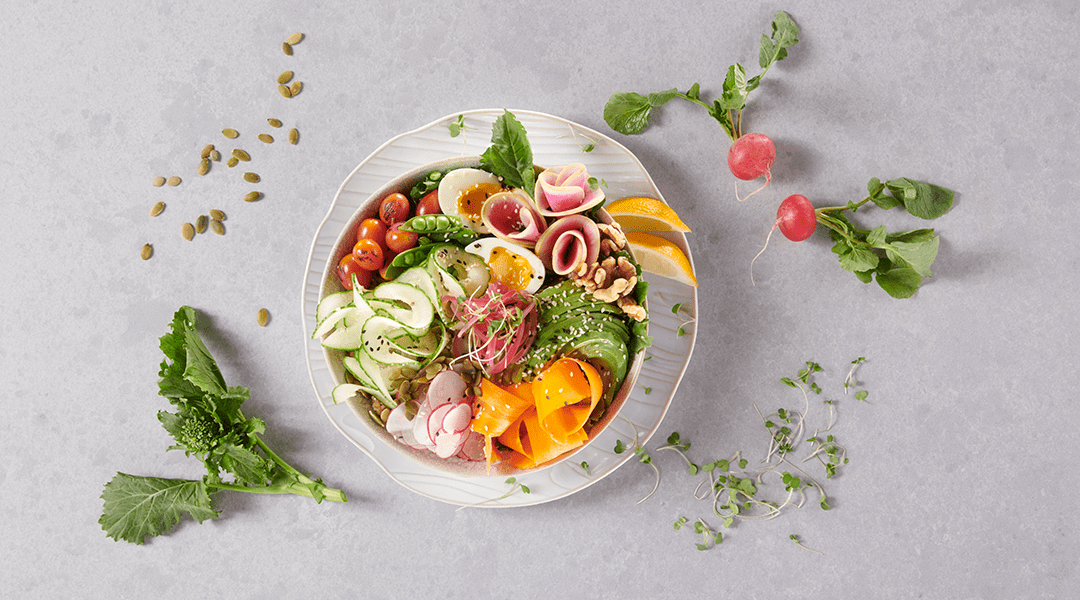

4. Some businesses, such as seasonal businesses and those in the foodservice

industry, are receiving further expansions of eligibility for some of these loans

(find more information about this on the SBA website).

5. If you have specific questions, talk to the SBA Loan Officer assigned to you,

as well as your bank.

Missed the Live? Watch it on livestream on our IGTV.

Looking for additional information? Click here.